Unlocking the Power of HSA or FSA: What Can You Buy?

Get the Most from Your HSA/FSA! Need help maximizing your tax savings?

Our experts are here to guide you through your HSA and FSA benefits.

In today’s fast-paced world, where health and financial wellness are paramount, Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) have emerged as indispensable tools. Designed to help individuals save for medical expenses with pre-tax dollars, these accounts offer a plethora of benefits. However, a question we hear frequently is, “What exactly can I buy with my HSA or FSA?”

At Sika, we seek to demystify HSA and FSA so that account holders can spend their funds when and where they need them – and save money in doing so. There are a lot of resources available explaining how HSA and FSA dollars can be used across typical health expenditures, such as prescription and over-the-counter medications, medical visit co-pays, medical supplies such as bandages and thermometers, mental health care, and dental and vision care. We won’t repeat those more common categories here. Instead, we’ve compiled a guide to help you learn about the less obvious ways to use your HSA/FSA funds.

Menstrual supplies

Menstrual supplies like pads, tampons, menstrual cups, period underwear, and other menstrual hygiene products are now eligible expenses that can be purchased tax-free with HSA and FSA funds. This is an important recent change that helps address the unfair “tampon tax” and high costs of menstrual care that have burdened those who menstruate for years. By using HSA/FSA money, individuals can save on these necessary monthly supplies. Recognizing menstrual products as qualified medical expenses makes period care more affordable and equitable for millions.

Blood oxygen monitors

Blood oxygen monitors, also known as pulse oximeters, are devices that measure the oxygen saturation levels in your blood. These monitors are considered eligible medical expenses that can be purchased using HSA and FSA funds. They are particularly useful for those with chronic respiratory conditions like COPD, asthma, or sleep apnea that affect breathing and oxygen levels. Tracking blood oxygen concentration at home allows patients to better manage their conditions and catch any concerning dips in levels early. With HSA/FSA coverage, this vital monitoring device is more affordable for those who need it.

Oral health support

Maintaining good oral hygiene is crucial for overall health, which is why many oral care products qualify for purchase with HSA and FSA funds. Items like toothbrushes, toothpaste, dental floss, anticavity products, denture adhesives, and dental guards for teeth grinding are all eligible expenses. Additionally, costs for dental treatments like fillings, crowns, extractions, and periodontal work can be covered using HSA/FSA money. Further, oral health saliva tests can be paid for with HSA/FSA. By using these tax-advantaged accounts, individuals and families can save significantly on out-of-pocket costs for dental cleanings, x-rays, and other preventative services that promote oral health. Proper oral care prevents bigger problems down the road, making these qualified expenses worthwhile investments.

Use tax-free HSA/FSA money for essential medical expenses.

Heart rate monitors

Heart rate monitors are wearable devices that allow you to track your heart rate in real-time during exercise or daily activities. These trackers qualify as eligible medical expenses that can be purchased using HSA and FSA funds. For those with heart and related medical conditions, monitoring heart rate provides important data to ensure you are exercising within safe levels. Heart rate monitors can also help detect irregular heart rhythms. By using HSA/FSA money for these devices, individuals can more easily afford the tools to support their heart health goals while enjoying tax savings.

Chronic pain relief

For those suffering from chronic pain conditions, finding effective relief is crucial for maintaining quality of life. Fortunately, many pain treatment devices qualify as eligible expenses that can be purchased with HSA and FSA funds. This includes transcutaneous electrical nerve stimulation (TENS) units that use mild electric currents to disrupt pain signals. Infrared light therapy devices that increase blood flow and reduce inflammation are also HSA/FSA eligible. Other covered items are heat/cold treatments, massage products, and braces/supports for injury treatment. Using tax-advantaged accounts allows chronic pain sufferers to more easily afford these therapeutic devices without further straining their finances. Having access to drug-free pain management options provides an important alternative for those seeking non-opioid solutions.

Women’s health

Women have unique healthcare needs throughout their lives, and many diagnostic tests and treatments related to female reproductive health, pregnancy and nursing, and perimenopause and postmenopause qualify as eligible expenses under HSA and FSA plans. Using tax-advantaged HSA/FSA funds can provide significant savings on expensive procedures like fertility treatments, reducing the financial burden for those looking to grow their family and care for themselves as they progress through different stages of life.

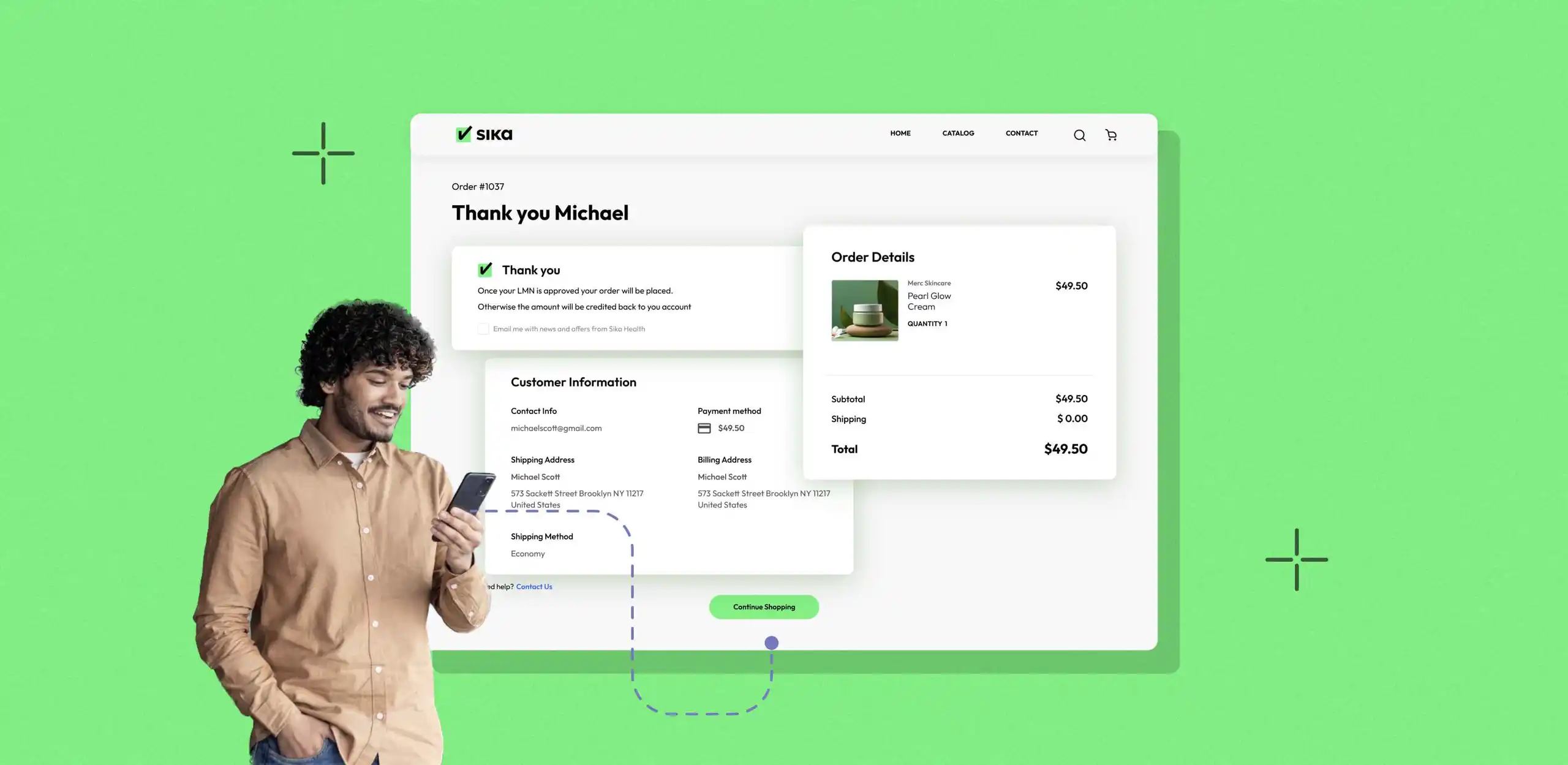

Empowering Smarter Health Choices with HSA/FSA

At Sika, we’re committed to empowering individuals to take control of their healthcare finances. By providing innovative solutions to customers and retailers, we aim to simplify the healthcare journey and improve outcomes for all. Start maximizing your healthcare dollars today! For more information about the categories above and retailers that accept HSA/FSA, visit sikahealth.com/shop.